WASHINGTON, DC – With the U.S. House and Senate considering legislation to intervene in beef and cattle markets, prices for cattle are at or near record highs calling into question the need for heavy-handed government interference.

“Just last week one cattle marketing analyst described the high prices as ‘stratospheric,’” said Julie Anna Potts, President and CEO of the North American Meat Institute. “As many industry economists have said, the beef and cattle markets are continuing to behave predictably given supply and demand and do not need government mandates and intervention.

“The Grassley-Fischer bill being marked-up in the Senate Agriculture Committee this week will cost producers in the largest cattle producing region millions of dollars, and producers around the country will lose the ability to market their cattle as they choose.

“The Meat and Poultry Special Investigator bill would establish a Special Investigator at the same time the U.S. Department of Agriculture is proposing to change the longstanding rules under the Packers and Stockyards Act. Establishing a new enforcement office at the same time USDA is changing the rules to be enforced is ill conceived: the regulated community would be subject to increased enforcement simultaneously with legal uncertainty.

“The North American Meat Institute remains opposed to S. 3870, the Meat and Poultry Special Investigator Act of 2022 and S. 4030, the Cattle Price Discovery and Transparency Act of 2022 (Grassley-Fischer bill).”

Reasons to oppose the Cattle Price Discovery and Transparency Act of 2022:

- The latest USDA annual report on livestock income shows cash receipts for the sale of cattle and calves increased 16 percent, from $63.1 billion in 2020 to $72.9 billion in 2021.

- Prices for cattle rose to seven-year highs in 2021, and now in 2022 prices are 17.5 percent above 2021 prices.

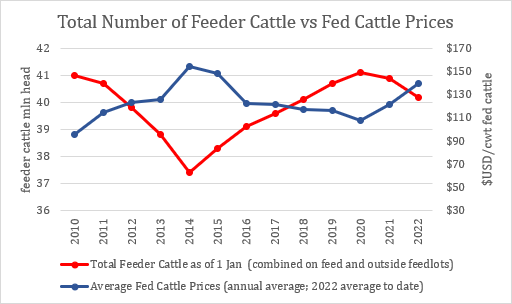

- As the chart above demonstrates, fed cattle prices are higher when supply/herd size is low/less.

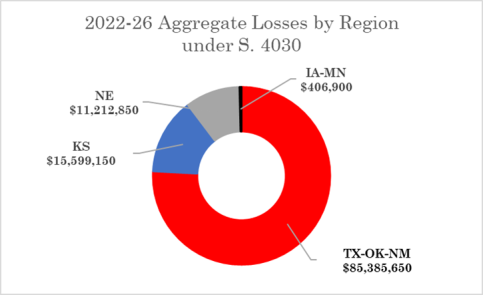

- Economists from the Agricultural and Food Policy Center at Texas A&M University found that the Grassley-Fischer bill, S. 4030, could cost producers even more than an earlier estimate of $112 million over five years ($50 a head on 2.3 million head).

- The economists at Texas A&M also found the mandate would benefit Iowa at the great expense of other regions: the Texas-Oklahoma-New Mexico region, Kansas, and Nebraska would shoulder the vast majority of the costs, while the Iowa-Minnesota region would escape relatively unscathed. (see chart)

- “Attempting to mandate more cattle be sold in a negotiated, cash basis has potential benefits and certain costs. The fact that most producers and packers choose to sell cattle using alternative marketing arrangements suggests they see benefits in this form of marketing in the form of increased certainty, lower transactions costs, and supply chain coordination. Mandating a certain percent of cattle be sold on a negotiated basis would entail some producers and packers foregoing a marketing method they currently find more desirable. That is a cost. Moreover, strengthening of consumer demand for beef over the past couple decades has occurred over a period in which there was increased use of formula pricing that rewarded quality improvements. Eroding the ability of consumers, retailers, and packers to incentivize quality through formulas and vertical coordination may have detrimental impacts on demand.” Dr. Jayson Lusk testifying before the House Agriculture Committee Subcommittee on Livestock and Foreign Agriculture.

- “AMA, which are agreements that occur outside of the spot cash market, they really help to minimize supply chain risks, reduce marketing costs, increase capacity utilization both at the feedlot level and the packer level, so really what this does is reduce operational cost and operational risks which in turn filters down to being able to pay higher prices for cattle as it goes back to the cow calf sector.” Dr. Dustin Aherin testifying before the House Agriculture Committee Subcommittee on Livestock and Foreign Agriculture.

- “It is important to understand packers did not force cattle feeders into Alternative Marketing Arrangements (AMAs). Producers were the brainchild of such ideas to get paid for the value produced. Value-based marketing systems are the ‘rising tide that lifts all boats.’ Mark Gardiner, President Gardiner Angus Ranch, testimony before the United States Senate Committee on Agriculture, Nutrition, & Forestry Hearing on “Examining Markets, Transparency, and Prices from Cattle Producer to Consumer”

- “Even if 100 percent of cattle were being sold on the cash market, it doesn’t mean prices would have been any higher than what we recently observed.” Dr. Jayson Lusk testifying before the House Agriculture Committee Subcommittee on Livestock and Foreign Agriculture.

Reasons to Oppose the Meat and Poultry Special Investigator Act of 2022:

- The bill spends millions in taxpayer dollars to hire more government lawyers for a newly created government office known as the Special Investigator for Meat and Poultry.

- This new office merely duplicates the authority already existing at the U.S. Department of Agriculture and Department of Justice.

- The new Special Investigator office would be established at the same time USDA is proposing to change the longstanding rules under the Packers and Stockyards Act. Creating a new enforcement office at the same time the Department is changing the rules to be enforced is ill conceived. The Special Investigator (and the staff of attorneys) would be emboldened and obligated to bring as many cases as possible, regardless of merit, to test the legal limits of the new rules. The resulting legal uncertainty will accelerate changes in livestock and poultry marketing that will add costs throughout the supply chain, hurting producers and consumers.

- This bill will not help reduce meat and poultry prices for Americans, and because of the legal uncertainty around the new rules, it could increase prices.

About North American Meat Institute

The Meat Institute is the United States’ oldest and largest trade association representing packers and processors of beef, pork, lamb, veal, turkey, and processed meat products. NAMI members include over 350 meat packing and processing companies, the majority of which have fewer than 100 employees, and account for over 95 percent of the United States’ output of meat and 70 percent of turkey production.