NEW YORK – Key takeaways

- Fresh food is more valued than ever; 9 in 10 respondents say it literally makes them happy.

- However, more than half of consumers (54%) feel stress from shopping in stores, resulting in less frequent visits.

- While price continues to be a primary driver of fresh food purchase decisions, safety has emerged as a prominent factor, both of which rate 85% or higher in importance to customers.

- Though a majority of consumers (70%) still value drivers like sustainability and locally sourced foods, they are now less urgent than they were last year.

Why this matters

COVID-19 has significantly changed how we think about, shop for, prepare and even stock up on fresh food. According to Deloitte’s new report, “The Future of Fresh: Patterns from the Pandemic,” the anxiety of shopping in store, combined with ongoing health and financial concerns, has disrupted consumer buying patterns, and created new opportunities for businesses. The study, which surveyed 2,000 U.S. consumers (aged 18 to 70), provides a view into new patterns of consumer behavior and dives into trends around shopping frequency, new priorities among purchase drivers and differing consumer reactions to stockouts.

Consumers are shopping less frequently

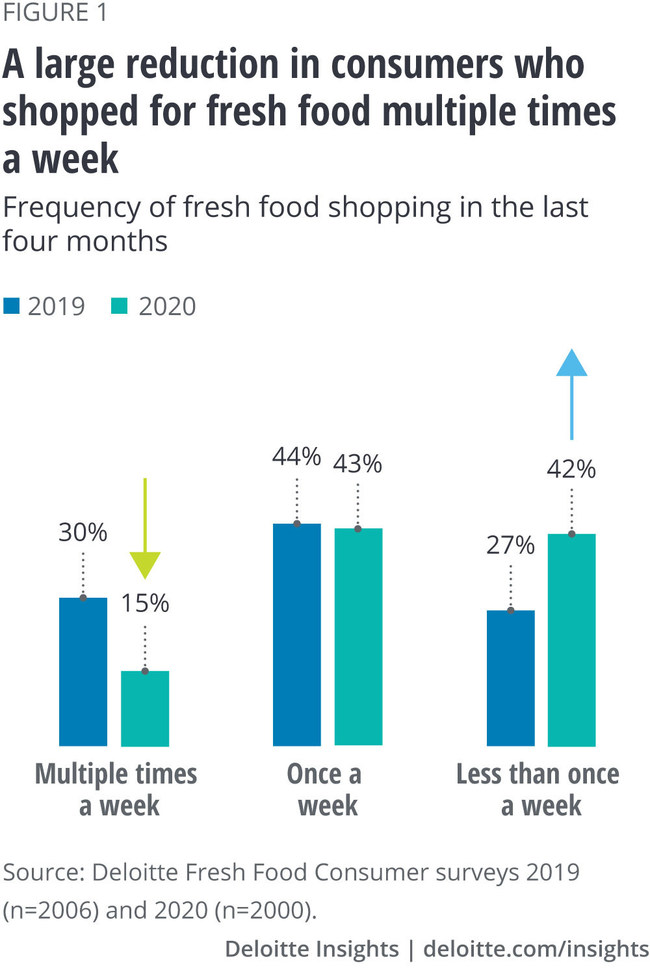

More than half of consumers surveyed (54%) feel stressed by in-store shopping; that stress is resulting in fewer visits to stores, and less frequent shopping trips. In the last year, the numbers of respondents who shopped for fresh food multiple times a week dropped by half (30% in 2019 versus 15% in 2020). In fact, based on credit card analysis, grocery stores are seeing less of some of their best fresh-purchasing customers as consumers who shop at least once a week comprise 80% of fresh food sales.

Safety and stockpiling alter purchase decisions

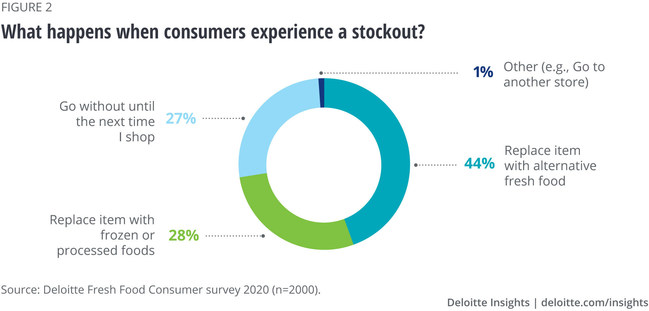

Consumers stockpiled food at the onset of the pandemic and continue to do so to some extent. This increased demand and other supply chain disruptions created unprecedented challenges for food manufacturers and grocery stores, resulting in stockouts for many categories, including fresh food. The survey found that nearly two-thirds (65%) of consumers responded that they had been unable to buy the fresh food they wanted because it was out of stock. Instead of going to another store, consumers are buying alternative food items or simply going without in an attempt to minimize shopping trips. When faced with a stockout during the last four months, more than 40% typically purchased an alternative fresh food item, and over half of respondents left the fresh food category entirely either to buy a frozen or processed replacement (28%) or not buy anything as a replacement (26%).

Until recently, safety was expected and not a primary concern in the fresh food category. However, consumers are increasingly focused on safety — for themselves, other shoppers, store employees and the workers who produce food. Consumers now indicate that safety is virtually of the same importance as price when it comes to fresh food selection (nearly 90% of respondents say these two categories are important purchase drivers).

Key quote

“Shifting consumer priorities and new habits brought on by COVID-19 continue to impact the fresh food category. With consumers spending less time commuting, they have more time to prepare fresh meals. However, they are conflicted and want to avoid the anxiety of shopping at multiple stores to purchase the fresh items they want. As consumers reduce the frequency of their fresh food purchases, there is a clear need for retailers to better understand and engage these emerging consumer personas to drive omni-channel growth.”

– Barb Renner, vice chairman, Deloitte LLP, and U.S. consumer products leader

New consumer personas drive disruption and innovation

Advanced analysis based on shopping frequency, amount of fresh food purchased, perceptions on price, channel usage, stress while shopping, and experience with stockouts have identified two distinct consumer profiles: Conventional (60% of those surveyed) consumers who have a traditional approach to their fresh shopping at the grocery store, and Contemporary (40% of those surveyed) consumers who are driving innovation in the fresh food category in a variety of ways.

- Contemporary consumers value a new kind of convenience that now includes availability. Whereas 68% of Contemporary consumers have bought at least some fresh food online, only 9% of Conventional consumers have done so.

- While trust had previously been a barrier to online sales of fresh food items, more than two-thirds (68%) of Contemporary consumers now trust their assigned in-store shoppers to select the best quality fresh food items available.

- Contemporary consumers are more willing to pay a premium for fresh food (75% compared to 62% of conventional consumers).

- Contemporary consumers are also buying more. They’ve increased their fresh purchases in the last four months at a level almost double that of conventional consumers (50% versus 27%, respectively).

- Nearly two-thirds (64%) of contemporary consumers felt brand was important when buying fresh food, but they’re not necessarily loyal. They’re more likely to be satisfied with replacement items (64% versus 36% for Conventional consumers).

- Contemporary consumers are also twice as likely to show interest in subscription boxes (59% compared to 26% for conventional consumers).

Key quote

“Despite the ongoing challenges fresh food retailers face, new consumer buying patterns are driving innovation and new opportunities. For grocery retailers, predicting what consumers are likely to purchase is essential to keeping core items in stock. Plus, in the event of stockouts, if retailers can better understand the patterns of both Conventional and Contemporary consumers, they can help steer them toward suitable replacements. Meeting consumer demand for healthy, sustainable and safe fresh food items, as well as providing new alternatives, will keep consumers returning across channels.”

– Brian Baker, managing director, retail and consumer goods,

Deloitte Consulting LLP

Connect with us on Twitter at @DeloitteCB or on LinkedIn @BarbRenner and @BrianBaker.

About Deloitte

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world’s most admired brands, including nearly 90% of the Fortune 500® and more than 7,000 private companies. Our people work across the industry sectors that drive and shape today’s marketplace — delivering measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to see challenges as opportunities to transform and thrive, and help lead the way toward a stronger economy and a healthy society. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Now celebrating 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte’s more than 312,000 people worldwide make an impact that matters at www.deloitte.com.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.